Electric vehicles (EVs) are undoubtedly contributing towards a greener future. Governments and councils worldwide are embracing this transformation by implementing EV charging infrastructure. However, a concern often revolves around recouping the initial investment. Businesses, councils and governments are able to capitalise on the increase of EVs through charger revenue – a strategy that not only offsets the costs but also generates a substantial return on investment.

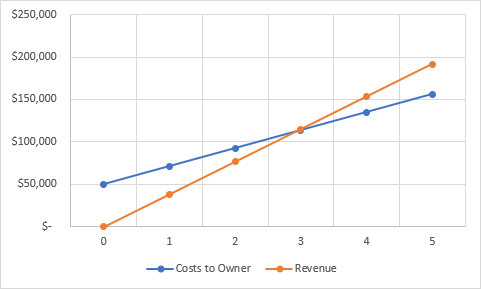

On average, a well-located DC charging station can generate around $100 revenue per day. By taking into consideration energy costs, O&M and Software costs of $2000 per year, this results in around $50 of profit. With an initial investment of $50,000 for a DC charger, the charger revenue strategy yields an ROI of approximately 21% per annum. This percentage represents much more than mere profitability; it signifies sustainability in both ecological and financial realms. The ability to not only pay off the initial investment but also generate a substantial profit.

Charger revenue exemplifies how forward-thinking councils and governments can balance economic growth with environmental sustainability. As EV adoption accelerates, the demand for charging infrastructure will only rise. By investing in such solutions and capitalising on charger revenue, councils and governments can effectively align financial progress with the broader goal of reducing carbon footprints.

Moreover, the $50,000 investment in EV charging stations is not just an expenditure; it’s an entryway into a profitable, eco-conscious future. Through strategic placement, customer-focused billing models, and efficient management, charger revenue can transform an upfront cost into a thriving revenue stream. It’s time for governments and councils to take the driver’s seat in shaping a sustainable, profitable tomorrow.

Have any questions? Contact us on:

1300 755 087

Disclaimer: the numerical values used in this blog are for illustrative purposes and may not reflect real-world conditions. Actual revenue and returns may vary based on location, charging patterns, and operational costs